Myanmar-Republic of Korea Economic Cooperation

강연자 : Ni Lar Myint Htoo

목차

- 1 Abstract

- 2 Introduction

- 3 Economic Cooperation between Myanmar and Korea

- 4 Trade Relationship between Myanmar and Korea

- 5 Foreign Direct Investment Condition in Myanmar

- 6 South-Korea FDI in Myanmar

- 7 Korea's ODA to Myanmar

- 8 Korea International Cooperation Agency (KOICA)

- 9 University of Economics

- 10 Conclusion

- 11 발표문 목록

Abstract

The Republic of Korea (ROK) and South East Asia nations, known as Association of South East Asia Nations (ASEAN) initiated sectoral dialogue relations in November 1989. The ROK was accorded a full Dialogue Partner status by ASEAN at the 24th ASEAN Ministerial Meeting (AMM) in July 1991 in Kuala Lumpur. Since the ASEAN-ROK partnership was elevated to a summit level in 1997 in Kuala Lumpur, relations between ASEAN and the ROK have broadened and deepened. From then on, the ASEAN countries have risen to become Korea’s principal target in external trade and overseas direct investment (ODI). For Korea, this relation can make the expansion of ODA support and the improvement of its trade. For South East Asia countries, need action points include the development of human resources, improvement of foreign investment environment, development of aid management organizations, restructuring of state-owned enterprises, promotion of private sector participation, and development of the financial and capital markets. This research focuses on the economic cooperation between Korea and the South East Asia countries, especially Myanmar. It is included to analyze the condition of trade and investment from Korea to South East Asia countries. The economic cooperation between Myanmar and the Republic of Korea would have a significance impact on the economic development of the two countries and in the South East Asia region. An appropriate strategy to promote FDI into Myanmar is either country diversification or sector diversification. South Korea’s official development assistance (ODA) will be a major and useful instrument for fostering a new constructive relationship with other ASEAN states. South Korea is interested in assisting with capacity-building and human resource development areas, through education and vocational training. Due to South Korea’s own socio-economic development experiences, it can be an invaluable asset and source of assistance for some ASEAN nations’ socio-economic development.

Introduction

The Republic of Korea is in Northeast Asia, physically thousands of miles apart from Southeast Asia. Historically, Korea and Southeast Asia have had contact and interaction. Korea’s economic relationship with ASEAN for both trade and investment dates far back. Indeed, when Korea’s economy began expanding vigorously in the past, especially before the normalization of its relationship with China in 1992, Southeast Asia — mainly ASEAN — was the main study area.

Korea has been a dialogue partner of ASEAN since July 1991. The land area of South Korea is 97,000 square km and Southeast Asia nations are 4.4 million square km. The population in Korea is 49 million and Southeast Asia nations are 600 million. Looking at the macroeconomic situation, Korea GDP is US$ 1.07 trillion with the growth rate of 6.2 % and ASEAN’s GDP is US$ 1.85 trillion with the growth rate of 7.1%. Total trade value in Korea is US$ 891 billion which included US$ 466 billion for exports and US$ 425 billion for imports. Total trade value in ASEAN is US$ 2.04 trillion which included US$ 1.07 trillion for exports and US$ 975.2 billion for imports.

The Republic of Korea’s (ROK) major strategic focus has always been to retain and improve its diplomatic and military ties with the United States against potential threats from North Korea. In recent years, however, the Republic of Korea has shown greater interest in improving ties with the countries of Southeast Asia.

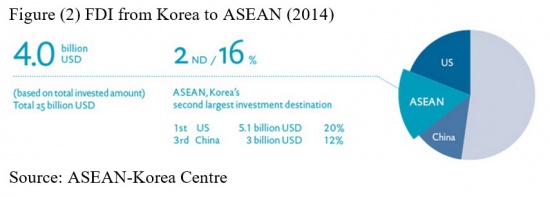

Southeast Asia is becoming increasingly important to South Korea’s economy: 1) After China, the region is South Korea’s second largest trading partner. 2) After the European Union, ASEAN is the second largest investment destination for South Korea’s Foreign Direct Investment outflow.

ASEAN and Korea are key partners of economic cooperation in the areas of trade, and investment. The trade volume between the two regions has increased 17 fold from 8.2 billion USD in 1989 to 138 billion USD (Export: 84.6 billion USD, Import: 53.4 billion USD) in 2014, and ASEAN has surpassed US, EU and Japan to become Korea’s second largest trade partner after China.

In 2013, two-way trade between ASEAN and ROK continued to grow and amounted to USD 135 billion compared with USD 131 billion the previous year. The ROK has maintained its position as the fifth largest trading partner of ASEAN, while ASEAN has become the second largest trade partner of the ROK. The two-way trade volume is expected to increase to USD 150 billion by 2015 as committed by the ASEAN-ROK Leaders at the 14th ASEAN-ROK Summit in November 2011.

In 2014, China is the largest trading partner and amounted US$ 235.4 billion (21% of total trade). ASEAN is the second largest trading partner and amounted US$ 138 billion (13% of total trade). ASEAN region is a net exporter with Australia, New Zeland, EU-28, India, Pakistan and U.S. In 2012, ASEAN’s trade surplus with EU -28 and U.S was reduced by half. On the other hand, ASEAN continued to be a net importer with China, Japan, korea and Rusia Federation as trade deficit with these partner even widened in 2012.

Since the ASEAN-Korea FTA came into full force in 2009, economic cooperation has expanded in various areas such as in investment and service, making ASEAN the second largest investment destination. Moreover, once negotiations to further liberalize the ASEAN-Korea FTA bear fruit, the goal of achieving the target of 200 billion USD by 2020 will gain impetus. Together with the invigoration of business related to ASEAN Connectivity – a core component of ASEAN Economic Community – the mutually beneficial ASEAN-Korea partnership is also expected to grow stronger.

The foreign direct investment flow from the ROK to ASEAN has increased tremendously by 105.88% from USD 1.9 billion in 2012 to USD 3.5 billion in 2013. FDI flow from Korea to ASEAN increased continuously to US$3.8 billion in 2014, making Korea ASEAN's second largest investor last year.

South Korea’s official development assistance (ODA) will be a major and useful instrument for fostering a new constructive relationship with other ASEAN states. ASEAN was the largest recipient of South Korea’s ODA (US$1.13bn) in 1987-2006. It is now in a position to assist other countries around the world. As an emerging donor, South Korea is interested in assisting with capacity-building and human resource development areas, through education and vocational training. Due to South Korea’s own socio-economic development experiences, it can be an invaluable asset and source of assistance for some ASEAN nations’ socio-economic development.

Korea has made a major commitment to increasing its development assistance especially in Asia, and particularly to “strategic partner countries,” Vietnam, the Philippines, Indonesia, Cambodia, Pakistan, Bangladesh and Sri Lanka. Korea’s comparative advantage in development cooperation lies in its strong capacity for training and knowledge transfer. This suggests that Korea’s ODA programs should focus on education, health, agricultural development, and ICT.

Considering all these economic factors, South Korea’s attempts to enhance ties with Southeast Asia are unsurprising. It was just a matter of time before South Korea realized the economic potency of Southeast Asia. Economic cooperation expanded further as ASEAN and Korea signed a free trade agreement at the 2009 Commemorative summit. During 2009, the Korea government made clear its many ambitious ASEAN-related plans. At the commemorative summit, three pillars of future Korean-ASEAN cooperation_ development cooperation, green growth, and cultural and people-to-people exchange_ were announced together with concrete programs to support each area. So, South Korea is trying to improve its bilateral relationships with the individual ASEAN countries.

Economic Cooperation between Myanmar and Korea

Myanmar and the Republic of Korea have long and historical friendship and close economic cooperation. Since 1975, diplomatic relations between the Republic of Korea and the Union of Myanmar (formerly Burma) was established. This relationship paved the way for bilateral trade and cultural ties. Economic Cooperation between Myanmar and the Republic of Korea took place since 1982.However, after South Korea created a democratically elected government in the late 1980s, leaders in Seoul joined international efforts to encourage both political and economic reforms in Myanmar.

The economies of Myanmar and Korea are complementary. Myanmar is rich in natural resources but lack of capital and technology know-how to fully exploit and utilize these resources. The South Korea, on the other hand, has limited natural resources but it is rich in capital and technology. The adoption of open market economy in Myanmar in 1989 has paved a way for economic and technical cooperation between the two countries. So, bilateral economic relations took the form of Korea exporting industrial products to Myanmar and Myanmar exporting natural resource based products to Korea. Trade relations between the two countries are in investment, technical cooperation and assistances for the development of Myanmar economy.

The Republic of the Union of Myanmar, namely Myanmar is the second largest country in South East Asia and 40 th largest country in the world. Located in the heart of South East Asia, linked between China and India, South East Asia and South Asia, Myanmar shares borders with the Andaman Sea and the Bay of Bengal, Bangladesh, Laos, India, China and Thailand. Nay Pyi Taw is our capital. The land area of our country is 676,577 sq km with the coastline of 2832 km. According to a national census conducted in 2014, the total Population of Myanmar is 51.42 million. Looking at the macroeconomic situation, GDP growth rate is 7.6% in 2012-2013. Myanmar is rich in natural resources covering energy such as Natural Gas, Petroleum, Gold, Jade, Ruby and other gemstones, Mineral (Copper, Tin, Antimony, Lead, Zinc, Silver), Teak and other timber and many potential for development.

Korea economy has been one of the dynamic and faster growing economics in the world. On the other hand, Republic of Korea is the 14th largest economy in the world. In 2013, it is a 9th largest importer and 7th largest exporter in the world. Under the present conditions, Republic of Korea lacks energy as well as other natural resources. With Myanmar being rich in these resources, Republic of Korea can have wide opportunities for economic growth in terms of economic cooperation between the two countries. Nowadays, Korean culture particularly that of Korean music and movies have a great influence on many of the younger generation here in Myanmar. Since these cultural influences are already in place, it would contribute to a great extent to the economic cooperation between the two countries.

Trade Relationship between Myanmar and Korea

Myanmar-Korea trade agreement was signed on 30 September, 1967. There were very little economic contacts between Myanmar and South Korea in the early days after achieving independence of Myanmar. Trade relations between South Korea and Myanmar have greatly improved in recent years. In 2012, South Korea former president Lee Myung –bak made a state visit to Natpyidaw, during which he promised his Burmese counterpart Thein Sein that South Korea would assist in developing Myanmar’s economy and education sector. Since then, trade between the two countries has quickly grown, reaching US$1.470 billion by the end of the 2013-14, of which Myanmar’s export to South Korea accounted for 352.92 million dollars while its import from the East Asian country stood at 1.217 billion dollars.

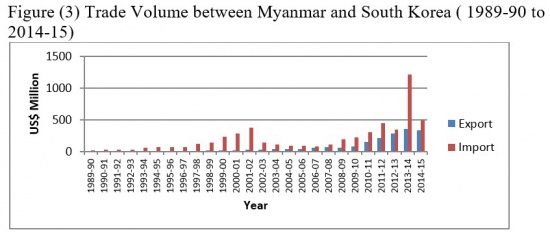

Myanmar export value to Korea was US$ 76.07 million in 2009-10, and increased to 341.04 million in 2014-15. So the export value increased over 4 times compared to 2009-10. The export value to Korea was the highest in 2013-14 due to the assistant of Korea. Myanmar’s imports from Korea also increased from 1988 -89 to 2001-02, US$ 18.39 million to 376.86 million. After 2002-03, imports from Korea decreased a little, but 2007-08 imports was again rose to US$ 107.54million.Since this resumption trade had continued uninterrupted till the present time. Figure (3) shows the volume of Myanmar’s exports to and imports from Korea from 1989-90 to 2014-15. In the balance of trade position between two countries, it is always in favor of Korea. To maintain expanded long-term trade relations between Myanmar and Korea, it was necessary to increase Myanmar’s production and exports to Korea and it also needs to more focus on the export –oriented quality from Myanmar side.

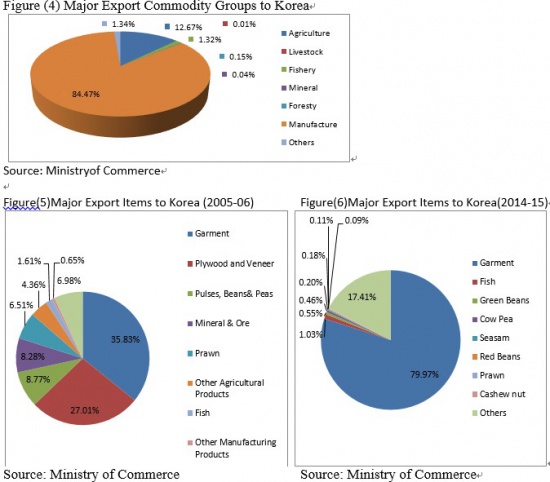

The major export commodity groups to Korea were agriculture, livestock, fishery, mineral, forestry, manufacture and others. Manufacture was the largest export to Korea which accounted US$ 288.08 million in 2014-15.Agriculture ranked second and accounted for 13% in total value of export to Korea.

In 2005-06, Myanmar’s exports to Korea were the value of US$ 38.54 million. The major export items were garment, plywood and veneer, pulses, beans& peas, mineral & ore, prawn, other agricultural products, fish, and other Manufacturing Products. The largest export item was garment (35.83%) and the second largest export item was plywood and veneer (27.01%). In 2014-15, Myanmar’s exports to Korea were the value of US$ 341.04 million. The major export items were garment, fish, green beans, cow pea, seas am, red beans, prawn, and cashew nut. The largest export item was garment (79.97%) and the second largest export item was fish (1.03%).

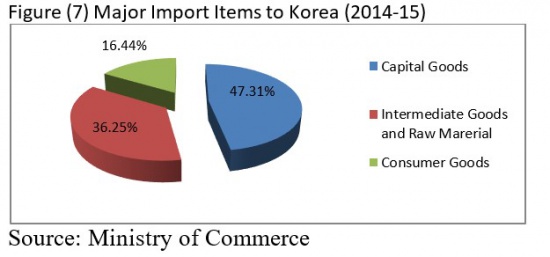

Korea has been one of the major suppliers in Myanmar’s imports market. Major import commodity groups were mainly capital goods, intermediate goods and raw material, and consumer goods. Capital goods were the largest import in 2014-15 and consisted 47% in total import value from Korea. Intermediate goods and raw material, and consumer goods hold second and third position in total import value from Korea, approximately 36% and 17% respectively.

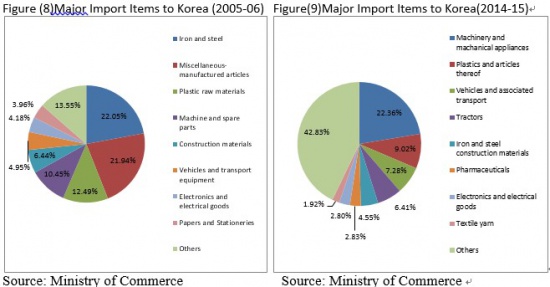

In 2005-06, Myanmar’s imports to Korea were the value of US$ 38.54 million. The major import items were Iron and steel, Miscellaneous-manufactured articles, Plastic raw materials, Machine and spare parts, Construction materials, Vehicles and transport equipment, Electronics and electrical goods, and Papers and Stationeries. The largest import item was Iron and steel (22.05%) and the second largest import item was Miscellaneous-manufactured articles (21.94%).

In 2014-15, Myanmar’s imports to Korea were the value of US$ 489.63 million. The major import items were Machinery and mechanical appliances, Plastics and articles thereof, Vehicles and associated transport, Tractors, Iron and steel construction materials, Pharmaceuticals, Electronics distribution and Installation goods, and textile yarn. The largest import item from Korea was machinery and mechanical appliances (22.36%) and the second largest import item was Plastics and articles thereof (9.02%).

In 2014-2015, Principle commodities for export included garment, fish, sesame seeds, pulses, prawn, cashew nut, footwear and fish. Principle commodities for import comprised of machinery and mechanical appliance, plastic and articles, vehicles and associated transport equipment, tractors, iron and steel construction materials, pharmaceuticals, electrical equipment, textile yarn, rubber and synthetic rubber, chemicals. In addition to trade relations, Myanmar’s economic relations with Korea also include investment relations.

Foreign Direct Investment Condition in Myanmar

FDI is extremely important for the development of a country, especially for a developing economy. Myanmar, as one of the developing countries in the Southeast Asia region, recognizes the significance of FDIs in its path for economic development. To narrow the development gap and to finance projects important for further development of Myanmar, inflows of FDI into the country are urgently needed. FDI inflows can effectively integrate the Myanmar economy with those of developed countries and extend the benefits of technology transfer and enhancing human resources. Furthermore, FDI can also create business opportunities for local SMEs. Although it may have its own consequences on developing countries; FDI is an acceptable tool for development in a country like Myanmar.

Myanmar has been in the process of undertaking economic reforms since 1988. Since then, the country officially adopted a market-oriented approach with an open arm to welcome FDI inflows. Accordingly, a series of legislation conducive to a market economy have been enacted while some of the existing laws were amended to be compatible with the changing economic environment. Soon after the adoption of a market-oriented economy, Myanmar Foreign Investment Law was promulgated on 30 November 1988 along with the formation of Myanmar Foreign Investment Commission on 7th, December 1988.

New foreign direct investment law was promulgated on 2nd November 2012, which aims at creating a more investment friendly climate and encouraging greater cooperation between local and foreign businesses operating. The new investment law compliments to the national reforms process and bring considerable amount of inflow investment, particular to traditional investment sectors, such as power, energy and mining. In addition, manufacturing, telecommunication, and hotel and tourism sectors are now receiving increasing number of new investments.

FDI is critical for Myanmar’s economic and industrial development. Indeed, Myanmar has attractive incentives to entice potential foreign investors: abundant natural and human resources; vast, cultivable land; long coastlines; navigable river systems; abundant material, gems, forests and low cost labor.

Given these incentives, Myanmar attracted a large amount of FDI inflows in FY 1996 and 2005; though it should be noted that the FDI inflow in FY 2005 was due to a single power sector project contracted with Thailand. Outside these two years, FDI inflow has been generally stagnant or decreasing overall. The reason for this trend is twofold: the decline of FDI after 1996 was due to the Asian financial crisis that occurred in 1997, and economic sanctions against Myanmar by the U.S. and the European Union have restricted FDI inflows from 1997 to the present.

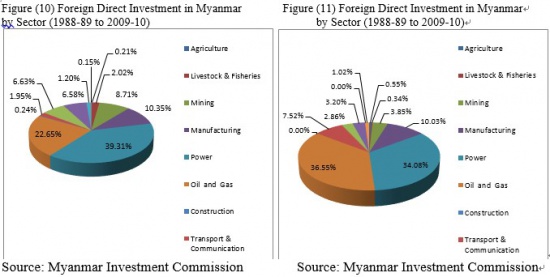

Foreign investment in Myanmar is mainly focused in the power and oil and gas sectors. From 1988-89 to 2009-10, power represented 39.31% of the total share of investment in Figure (10).

Together with oil and gas (22.65%), these sectors contributed about 61.96%. The manufacturing sector ranked third overall with 10.35% of the total share of investment. Mining and hotel and tourism also received tangible amounts of investment, about 8.71% and 6.63% respectively. The amount invested into other sectors is relatively small and Myanmar’s primary economic sector—agriculture—received only 0.21 percent of total foreign investment.

From 2009-10 to 2014-15, oil and gas sector received 36.55% of the total share of investment. Power and manufacturing were the second and third sectors receiving most FDI. The transport and telecommunication sector saw investments rose to $2870 million and fourth overall with 7.52%. The FDI inflows into the rest sectors are relatively small in terms of their contribution to the total investment. (Figure 11)

In the 2013-2014, which ends on March 31, Myanmar attracted about $3.5 billion in FDI, half of which flowed into its labour-intensive manufacturing sector. Foreign direct investment in Myanmar grew sharply during the 2014-2015 and reached a record $8 billion, a more than doubling of FDI compared to the year before, according to the Myanmar Investment Commission, which said the oil and gas sector was the main driver of FDI growth. Foreign investment in Myanmar is increasing more and more nowadays not only in number of enterprises but also in capital amount. Currently, a total of 707 foreign enterprises in 12 sectors from 36 countries were permitted with the total pledge amount of US$ 80.10 billion up to the end of April, 2015.

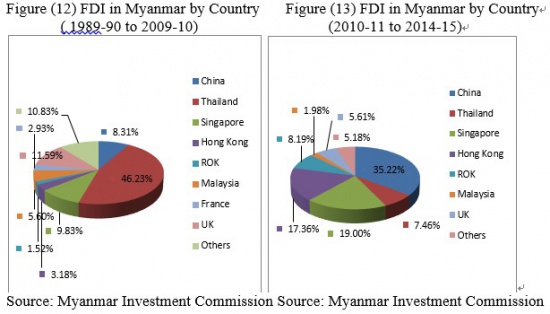

The total amount of investment by top countries in terms of the value of FDI inflows into Myanmar during the period is shown in Figure (12). From 1988-89 to 2009-10, Thailand significantly leads all other countries with about 46.23%, which represents nearly half of the total investments in Myanmar throughout the period. UK stands second with its investment about 11.59%. It is followed by Singapore with about 9.83%; China is fourth with about 8.31%. Korea ranked eighth in these periods.

From 2010-11 to 2014-15, China is the largest investors in cumulative total (35.15%). Singapore and Hong Kong were the second and third largest investors. Korea ranked fourth in cumulative total (8.17%). Singapore-listed companies comprised more than half of the investment volume in 2014-2015, reflecting an apparent trend of managing local projects remotely from the investment haven, particularly for oil and gas projects.UK was the second largest investors in that year.

Hong Kong-based firms were the third-largest investors with $850 million, followed by China-registered companies with $516 million, according to DICA. Among the top ten investor countries, three countries are from ASEAN, two are from EU, and three are from other parts of Asia.

South-Korea FDI in Myanmar

The co-operation and collaboration between Myanmar and Korea have flourished on various fronts over the years, ranging from trade to cultural activities. Korea companies and entrepreneurs have played an important role in Myanmar’s business community, with many companies doing business in Myanmar. South Korea’s direct investment started in the electronic products sector in 1990. Since then, South Korea’s direct investment has expanded in various sectors.

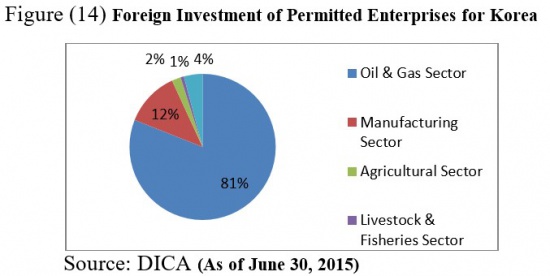

According to official statistics, South Korean investment in Myanmar amounted to 3.072 billion US$ in 96 projects as of June 2014, accounting for 6.58 % of the total foreign input and ranking the 6th in Myanmar’s foreign investment line-up since Myanmar opened its door in late 1988. According to the DICA statistics, total registration companies from Korea are 353 companies on 31 June, 2015, mostly from the manufacturing and service sectors, operate in Myanmar. They include 215 service companies (60.91%), 87 industry companies (24.65%), 41 trading companies (11.61%) and other type of companies. Oil and gas sector amounted to US$ 2733.88 million, accounting for 81.01 % of total FDI inflow. It is the largest sector in FDI. The second largest sector is manufacturing sector which amounted US$ 409.33 million and accounted 12.13 % of total FDI. These are shown in Figure (14).

Korea's ODA to Myanmar

Korea has been assisting Myanmar’s economic development through ODA. Korea’s ODA to Myanmar peaked in 1990 and 1991, US$ 58.7 million and US$ 64 million, but grew inconsistently since then. The decline has been drastic from 2001. This decline has been attributed to a number of factors, particularly to the embargo on Myanmar imposed by the international community, the ongoing unstable political and social conflicts within the nation, and its poor condition for investment.

Having reached the status of a newly industrialized economy (NIE), Korea started providing official development assistance (ODA) in mid-1980s. The establishment of an Economic Development Cooperation Fund (EDCF), a kind of concessional loan, in 1987, under the auspices of the Export-Import Bank of Korea (Korea Exim bank), marked the beginning of Korea’s ODA.

While the EDCF provided loans to developing countries to help strengthen their industrial capacity, assist in the stabilization of their economies, and promote economic ties with Korea, the Korean government went another step forward. In 1991, it established the Korea International Cooperation Agency (KOICA), which has since then been responsible for grant-type ODA. The development assistance programs of Korea are largely managed by these two institutions.

With the aim to assist in economic development and public welfare improvement in developing countries, South Korea has been increasing its ODA on a regular basis. Myanmar was also one of main recipients of South Korean aid but the amount of aid is smaller than that of other East Asian countries due to the deteriorating political and economic conditions of Myanmar.

Korea ODA for Myanmar is smaller amount comparing with other ASEAN countries. ODA grants were allocated to development projects, development research projects and NGO programs. Viet Nam received the largest amount of ODA from Korea in new ASEAN members. Cambodia and Lao were second and third position received of ODA.

Given geographical proximity and cultural similarities with Asian partner countries, the Korean government has allocated the greatest amount of its ODA to Asian partner countries. There are eleven countries out of the twenty-four priority partner countries located in Asia and more than half of Korea’s bilateral aid is distributed to Asian region. The Korean government supported partner countries in Asia based on each partner countries’ demands; however promoting private sector’s development, environmentally sustainable development, and reducing disparity of development by pro-poor growth are important considerations in delivering ODA interventions.

Korea International Cooperation Agency (KOICA)

KOICA founded in 1991, opened its Myanmar office in 2001. KOICA provides its grant assistance and technical support in the areas where the needs of the Government of Myanmar can meet. KOICA conducts various projects and programs in collaboration with the Government of Myanmar, as well as other donor countries, international agencies, NGOs and private sector in order to help Myanmar achieve the smooth reform process and development results that can positively benefit the people of Myanmar. In Myanmar, KOICA specifically focuses on: - Agriculture and Rural Development, Industrial development, Economic Governance, Administrative Governance, Human Resources Development.

KOICA provides financial support to NGOs and Korea universities to help them implement projects aiming at poverty eradication and promotion of wellbeing for the local people. In 2013, KOICA supported 10 projects, mostly focusing on community and capacity development in Myanmar. KOICA had sent the project proposals to FERD for the opinions of the concerned ministries on the proposals for (6) Seminar Programs and (5) Project Aid Program for 2014. For 2015-16, Myanmar proposed 7 projects to get help for implement them.

In the late 1980s, a small number of Myanmar students registered in a handful of universities and theological institutions in Korea. Korea is a program through which KOICA provides volunteers and advisers/experts to partner countries. KOICA provides volunteers and advisers in the fields requested from the Government of Myanmar. Fellowship Program since 1991, KOICA has provided educational opportunities to the Myanmar government officials in the field of health, environment, public administration, agriculture, etc. This fellowship program consists of short-term training courses and Master’s degree programs, and aims at strengthening the government officials’ capacity. There are 218 scholarships provided from Korea from 1994-95 to 2014-15. Among them, scholarships from KOICA represent 27% of total scholarships in this period. Other organizations that provided scholarship are KDI, KEDI, KFAS, Korea Foundation, KOSEC Myanmar and Korea government

Research Capabilities of Higher Education

Research Capabilities is the essence and critical part of Higher Education institutions. Therefore, the education plans seek to build research capabilities to generate new knowledge, modern technology, and those that will have a direct impact on the development of the nation. Research Centres previously established at higher education institutions are being upgraded and new centres instituted under the long-term education development plan in order to promote research and scholarship and to provide research services to industry and enterprises in the region in which the universities are established and contribute to their development. Activities of some of the main research centres located at major universities in Myanmar are highlighted below.

The Universities Research Centre (URC)

Universities’ Research Centre, commonly known as URC, is a multidisciplinary research laboratory established in 1985 to assist and foster research activities in Universities, colleges and institutes of higher education as well as to provide research assistance/services to private enterprises and government organizations.

Asia Research Centre, Yangon University

Collaborating with international research centers is also emphasized. The Asia Research Centre (ARC) was opened at Universities’ Research Centre, Yangon University (YU) on 9 August 2002. The primary financier of ARC, YU is the Korea Foundation for Advanced Studies (KFAS) that signed a Memorandum of Understanding with Yangon University on 9 April 2002. The mission of ARC,YU is to assist in the preparation of Myanmar intellectual advancement and to contribute to the development of the frontiers of national science development by fostering scientific activities and their applications to industry. For the long term development of research, the long term plan aims to establish higher education institutions specializing in research and enhance collaborative research with international research centers and organizations.

University of Economics

Yangon University of economics (YUE) was founded in 1964 and it offers diploma, undergraduate and postgraduate courses. Many outstanding high-ranked officials are currently serving to the nation in various areas got their respective degrees from YUE. YUE has strong connections with academic society to government officials as well as to every non- government executives and private entrepreneurs who have attended one or more courses offered by YUE. It can reach out to academic and research concerning with economic and administrative fields. This demonstrates that YUE is in a unique strategic position to make cooperation with other international universities and organization. There are 29 international universities and organization cooperating with YUE. Among them two are Korea organizations/universities, namely, Korea Myanmar Research Association and Woosong University. Moreover, YUE is now expecting to establish a research centre to pursue coordination with Korean Studies research. That research centre will be a national research centre to assist relationship between Myanmar and Korea in various fields.

Conclusion

Myanmar possesses a huge economic potential as a result of its abundant natural and human resources that are currently underused. Myanmar is indeed exceptionally rich in forest resources, as these cover about 50 % of the total land area. According to its climatic zones from temperate to arid and tropical, several variant forests types exist. These comprise the temperate forests in the north, deciduous forests and dry forests in the central part and semitropical rain forests in the south. Myanmar is rich in mineral resources and minerals of potential importance are oil and gas, gem, copper, goal, lead, zinc, silver, tin and tungsten, antimony, chromium and nickel. Myanmar’s offshore natural gas reserves are approximately estimated at 10 trillion cubic feet.

Undeniably, investment levels in Myanmar reflect only resource-seeking investment. Therefore, there are great opportunities for South Korea to expand investment and partnership with Myanmar, in order to capitalize on the geostrategic potential. It is also necessary to provide for greater investment in the manufacturing sector along with technology transfers in agriculture and IT. Greater cooperation in these areas should be encouraged. This includes the mutual exchange of economic data as well as personal exchanges, such as the transfer of South Korean economic development planning experience, expert exchanges, and trainee and joint development research projects in various sectors.

The expansion of Korean- Myanmar bilateral relations into a long-term economic partnership will have the potential to deliver important economic and strategic benefits to both countries. Mutual benefits on both sides can be achieved through closer economic cooperation. For Myanmar side, Myanmar relies a great deal on ASEAN countries in terms of trade and FDI. External sanctions from the U.S. and EU do not favor on country diversification. Therefore, Myanmar needs to rely on its ASEAN counterparts and other Asian countries for FDI inflow. It should strengthen its FDI relationships with the leading ASEAN countries, especially Thailand, Singapore, and Malaysia. In the long term, Myanmar should expand its FDI customer base to include other NIEs such as Korea, Hong Kong, Taiwan, and other rich countries in the Middle East like Saudi Arabia and the UAE. Myanmar needs to encourage them to invest in other sectors of its economy apart from primary resources-based sector.

As previously discussed, FDI inflows into Myanmar are concentrated in the power and oil and gas sectors. In this regard, Myanmar needs to show the attractiveness of other economic sectors to potential foreign investors and encourage them to increase their investment in these sectors through using appropriate measures. In order for Myanmar to increase its attractiveness to FDI from South Korea or other countries, the country must first provide a safer environment for private sector investment and foreign entrepreneurs. In addition, investment in the manufacturing and agricultural sectors needs to be encouraged, along with technology and skill transfers.

If short-term benefits from Myanmar are the main purpose for South Korean-Myanmar relations, then South Korea should continue to invest in Myanmar’s extraction industries. In the long-run, however, Myanmar needs to attract greater FDI and economic assistance for industrial and agricultural development. This will establish the structural foundations for sustainable economic development. Myanmar as a resource rich country has the potential to emerge as a substantial consumer market. What is more, its geographic location makes it an ideal base for reaching larger consumer markets such as India and China and gaining access to the Indian Ocean from mainland Asia.

For Korea side, South Korea has the means to provide these programs and human networks to spur both development and growth of the South East Asia including Myanmar economy. In doing all these programs, South Korea will unquestionably gain significant power in South East Asia.